The Architecture of Debt: Technical Mechanics & Behavioral Traps

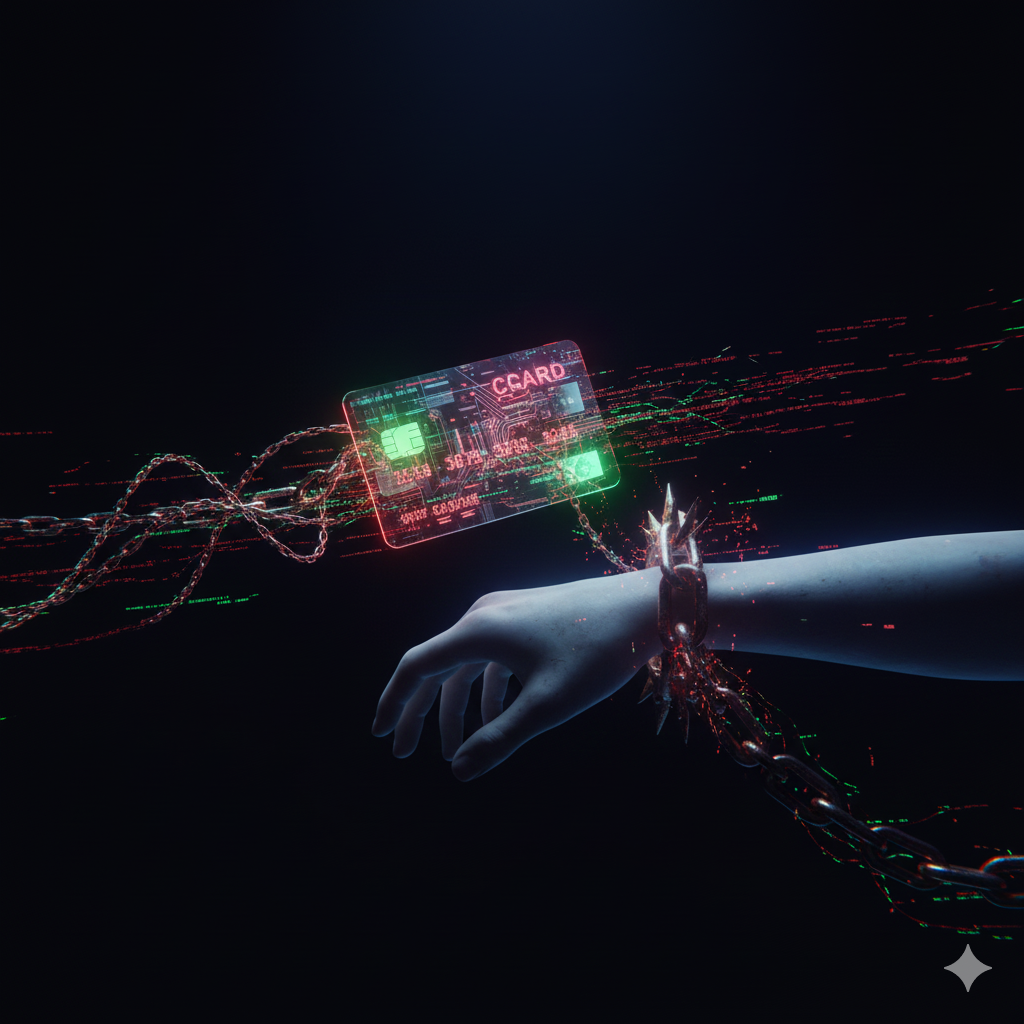

Abstract: The credit card debt trap is not merely a mathematical anomaly; it is a sophisticated system designed to exploit specific cognitive biases. Financial institutions engineer products that decouple the “pleasure of consumption” from the “pain of payment.” This article deconstructs the intersection of revolving credit mechanics (compounding interest, minimum due algorithms) and behavioral finance (hyperbolic discounting, pain of paying) to provide a comprehensive blueprint for debt evasion.

1. Behavioral Analysis: Why Your Brain Loves Debt

Before dissecting the math, we must understand the biological hardware. Your brain is wired to fail at credit card management due to three specific cognitive glitches.

Research in neuroeconomics reveals that paying with cash activates the insula, the brain region associated with physical pain and disgust. Credit cards anesthetize this response. By decoupling the transaction from the immediate loss of wealth, credit cards reduce the “friction” of spending. You swipe now, but the “pain” is deferred by 45 days. This temporal gap creates a false sense of liquidity [web:11][web:13].

1.1 Hyperbolic Discounting

Humans value immediate rewards disproportionately higher than future costs. A ₹5,000 dinner tonight offers immediate dopamine (pleasure). The ₹6,500 cost (principal + interest) six months later is an abstract, future problem. Credit cards are the perfect delivery mechanism for this bias, allowing you to satisfy the “now self” at the expense of the “future self” [web:9].

2. Technical Mechanics: The “Minimum Due” Algorithm

The “Debt Trap” relies on a mathematical asymmetry between the Minimum Amount Due (MAD) and the finance charges. It is designed to keep the principal balance static while maximizing revenue from interest.

2.1 The Interest Calculation Engine

Credit card interest uses the Average Daily Balance (ADB) method. The formula is:

Once the “grace period” is breached (by carrying even ₹1 balance), the interest-free window collapses. Interest is then applied retroactively to the date of transaction, not the statement date. Additionally, GST at 18% is levied on the interest, effectively compounding the cost.

3. Quantitative Impact: The Rolling Bill Simulation

Let us simulate the erosion of wealth using a fixed debt scenario. This model assumes you stop spending and only pay the minimum due.

- Principal Debt (P): ₹1,00,000

- APR: 42% (3.5% per month)

- Minimum Payment: 5% of outstanding balance

| Month | Opening Balance | Interest (3.5%) | GST on Int (18%) | Min Payment (5%) | Principal Paid | Closing Balance |

|---|---|---|---|---|---|---|

| 1 | 100,000 | 3,500 | 630 | 5,000 | 870 | 99,130 |

| 2 | 99,130 | 3,470 | 625 | 4,957 | 862 | 98,268 |

| 24 (2 Yrs) | 81,500 | 2,852 | 513 | 4,075 | 710 | 80,790 |

The Reality: After paying ₹1.1 Lakhs over 2 years, the principal reduces by only ~₹19,000. The system is designed such that 80% of your payment services the interest, and only 20% touches the debt.

4. Psychological & Technical Remediation

Debt often triggers a “Shame Spiral”—avoiding bank calls, not opening emails, and denial. This is a defense mechanism. To solve the problem, we must shift from “Moralizing” (I am bad with money) to “Strategizing” (This is a math problem) [web:12].

4.1 The Avalanche Method (Mathematical Optimization)

This method minimizes the total interest paid.

- List debts by APR (highest to lowest).

- Pay minimums on all.

- attack the highest APR debt with all surplus cash.

4.2 The Snowball Method (Psychological Optimization)

This method maximizes dopamine hits to keep you motivated.

- List debts by Balance (smallest to largest).

- Pay off the smallest debt first.

- The “win” of closing an account provides the psychological fuel to tackle the next one.

4.3 Algorithmic Arbitrage (Consolidation)

Replace high-cost debt with low-cost debt.

- Action: Take a Personal Loan @ 14%.

- Execute: Pay off Card Debt @ 42%.

- Result: Immediate 28% reduction in interest costs.

FAQ: Technical & Behavioral Insights

Psychology: This is the “Wealth Effect.” Your brain conflates “Access to Credit” with “Ownership of Money.” A ₹5 Lakh limit feels like ₹5 Lakh in the bank, leading to lifestyle inflation.

Technical: The 45-day interest-free period is conditional. It exists ONLY if the previous bill was paid in full. If you carry ₹1 forward, the free period is voided for all new purchases.

Technical: Yes, it increases your Credit Utilization Ratio.

Behavioral: If the card is a temptation trigger, close it anyway. A 20-point drop in CIBIL is better than ₹2 Lakh in debt.

Analysis: It is calibrated to be low enough to be affordable (preventing default) but high enough to cover interest (ensuring profit), maximizing the customer’s lifetime value to the bank.